|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding the Harp Housing Program: A Comprehensive GuideThe Home Affordable Refinance Program (HARP) was a federal initiative designed to help homeowners refinance their mortgages. Established in response to the financial crisis, it provided opportunities for those who were underwater on their homes to benefit from lower interest rates. What is the Harp Housing Program?The Harp Housing Program was introduced by the Federal Housing Finance Agency in 2009. Its primary aim was to assist homeowners who were current on their mortgage payments but had little or no equity in their homes. Eligibility Criteria

This program was specifically targeted at homeowners who found it difficult to refinance due to a decline in home values. For more details on current refinancing options, you might consider exploring home mortgage rates today. Benefits of the ProgramThe Harp Housing Program offered several significant benefits, including:

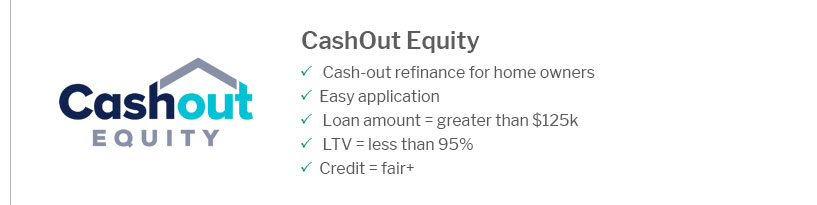

Challenges and ConsiderationsWhile the program offered numerous benefits, there were also challenges. Some homeowners found the eligibility criteria restrictive, and others encountered difficulties with paperwork or lender participation. Key ConsiderationsBefore opting for refinancing under any program, it’s crucial to weigh the costs and benefits. Homeowners should be aware of any potential fees and how these might affect their long-term financial situation. To find a reliable lender, visiting platforms that list reputable mortgage service providers could be beneficial. Frequently Asked QuestionsWhat was the main goal of the Harp Housing Program?The primary goal was to enable homeowners who were current on their mortgage but had little equity to refinance and secure lower interest rates. Who was eligible for HARP?Eligibility required that the mortgage be owned by Fannie Mae or Freddie Mac, originated on or before May 31, 2009, and the homeowner must be current on their mortgage payments. Are there alternatives to the HARP program now?Yes, there are other refinancing programs available today. Homeowners should explore current options and compare offers from different lenders to find the best fit for their needs. https://www.columbusga.gov/communityreinvestment/ARP/HARP

... Program (HARP) is to extend support to vulnerable low-income households by addressing the need to preserve affordable housing. CCG has allocated $3,000,000 ... https://www.youtube.com/watch?v=2CWh-DzkZCI

HARP Housing Program taking applications. 73 views 8 months ago ...more. NewsWatch 12. 11.5K. Subscribe. https://furmancenter.org/coredata/directory/entry/housing-asset-renewal-program

The Housing Asset Renewal Program (HARP) was a pilot program that provided funding to convert unsold condominiums, market ...

|

|---|